32+ calculating income for mortgage

The Best Lenders All In 1 Place. Web Calculating your debt-to-income ratio.

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

58700 annual income or approximately 4892 per month.

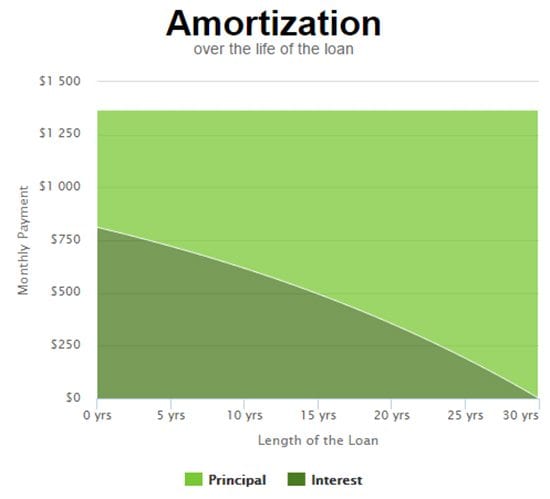

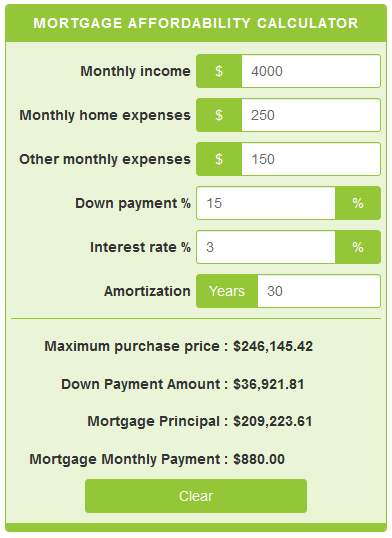

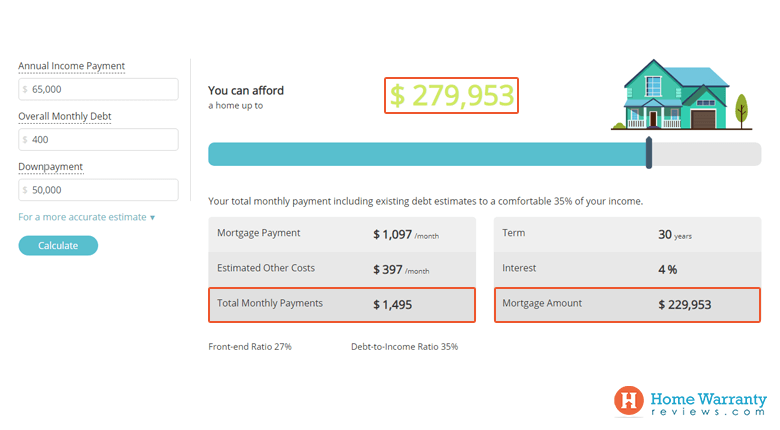

. Web To find your true income basis for a personalized debt-to-income calculation youd subtract 13500 from 70000 then add back 2200. Web A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property taxes and insurance.

This 28 is often referred to as a safe mortgage-to-income ratio or a good general guideline for mortgage payments. To include liabilities and determine what you can afford use the calculator above. Take the First Step Towards Your Dream Home See If You Qualify.

Web When you apply for a mortgage the lender will check your monthly income to make sure you can afford to make regular house payments. This debt to income calculator will assist you in estimating your monthly income for mortgage preapproval and determining the debt to income ratio. Check Your Official Eligibility Today.

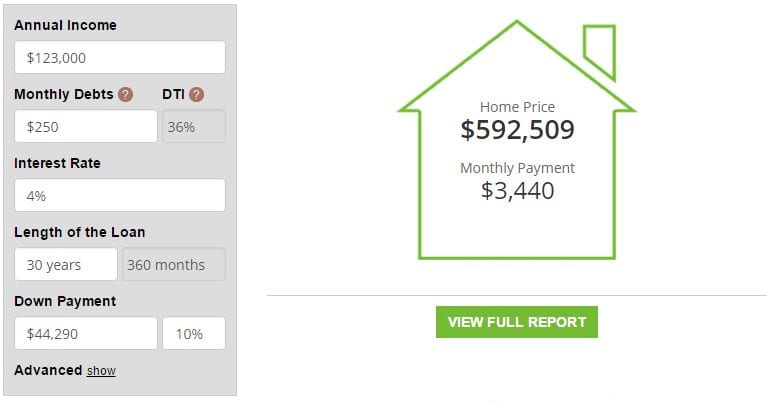

Web Monthly Income X 28 monthly PI TI Monthly Income X 36 - Other loan payments monthly PI TI Maximum principal and interest PI This is your maximum monthly principal and interest payment. Web The formula for calculating your DTI is actually pretty simple. Youll just need to add up your total monthly debt payments and divide it by your total gross monthly income.

Web The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load including housing costs is no more than 40 of your gross household income. However if the current years overtime or bonus income falls by 20 or more from the prior year the Mortgagee must use the current years revenue. Web The next step is to compare your expenses to your pre-tax income.

For this example well use the median family gross income annual pre-tax earnings of 86011. You would calculate your DTI as follows. Were not including monthly liabilities in estimating the income you need for a 325000 home.

For example if a borrowers mortgage payment including principal interest taxes and insurance is 1500 and their monthly income is 6000 the front-end ratio is 25. Freelancers business owners and other independent contractors are considered self-employed. Web A 325000 house with a 5 interest rate for 30 years and 16250 5 down will require an annual income of 82975.

Now say your gross monthly income is 5000. Low Fixed Mortgage Refinance Rates Updated Daily. Web That gives you a total of 1600 in monthly obligations.

To determine our housing expense ratio well divide our expense 192550 by our income 716758. Web You can calculate affordability based on your annual income monthly debts and down payment or based on your estimated monthly payments and down payment amount. Web To compute effective Income for employees with overtime or bonus Income the mortgagee must average the income earned over the past two years.

Multiply the result by 100 and you have a DTI of 32. No SNN Needed to Check Rates. It is calculated by subtracting your monthly taxes and insurance from your monthly PITI payment.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web A front-end ratio is calculated by taking the full mortgage payment and dividing it by your gross monthly income. Web Calculating income for mortgage underwriting.

You can then use your income basis to determine your maximum recommended debt load based on lenders debt-to-income. Lets say you have. Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability including specific amounts of property taxes homeowners.

For some borrowers monthly income isnt easy to calculate. That breaks down to 716758 monthly. Ad Updated FHA Loan Requirements for 2023.

DTI measures your debts as a percentage of your income. Rounded up our result is. Monthly debt obligations divided by Monthly income times 100 equals DTI.

The first step to prequalify for a mortgage loan is. Ad Compare Lowest Mortgage Refinance Rates Today For 2023. Ad Calculate Your Payment with 0 Down.

Mortgage Broker Tea Tree Gully Golden Grove Athelstone Mortgage Choice

How To Calculate Self Employed Income For Mortgage Loans My Perfect Mortgage

5218 N Keller Rd Spokane Valley Wa 99216 Mls 202225840 Zillow

How Much House Can You Afford Readynest

How A Mortgage Underwriter Calculates A Homebuyer S Income In Plain English

Mortgage Affordability Calculator Calculatorscanada Ca

Bnb Grant Round 1 Grants Dorahacks

Vital Aspects Of Your Credit Health Valley West Mortgage

Economist S View Real Median Household Income In The Us

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Find Out If You Can Afford Your Dream Home

0 Hwy 62 Vidal Ca Vidal Ca 92280 Compass

11214 E 27th Ave Spokane Wa 99206 Zillow

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

Calculating Income For Mortgages With Schedule C Or C Ez Youtube

Home Affordability Calculator

![]()

Mortgage Income Calculator Nerdwallet